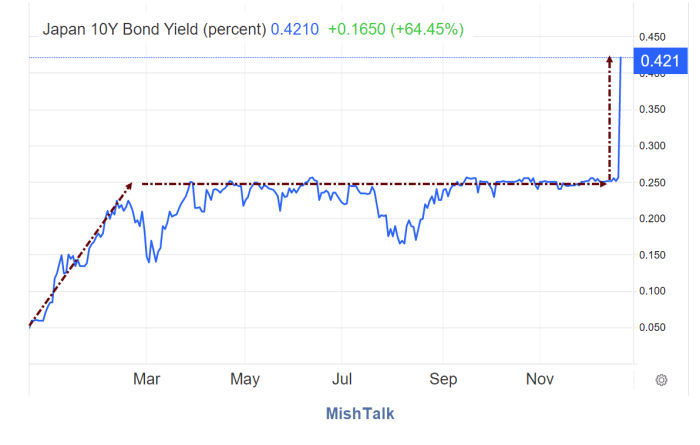

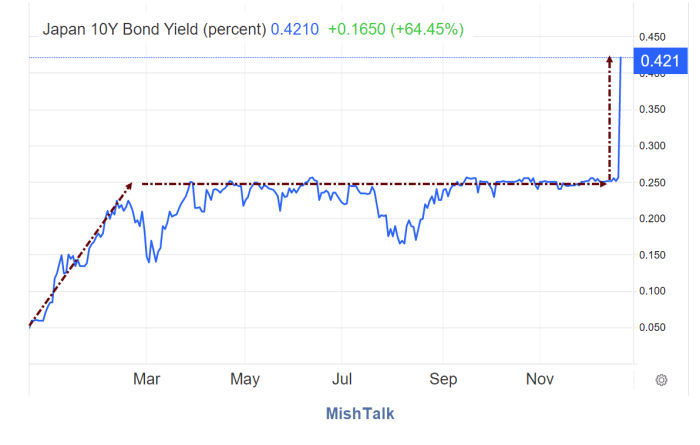

A surprise move by the Bank of Japan yesterday triggered a rise in bond yields and strengthened a move lower in the US dollar.

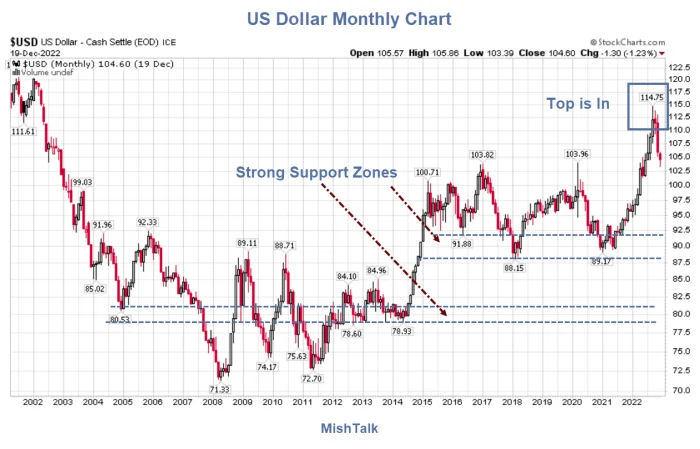

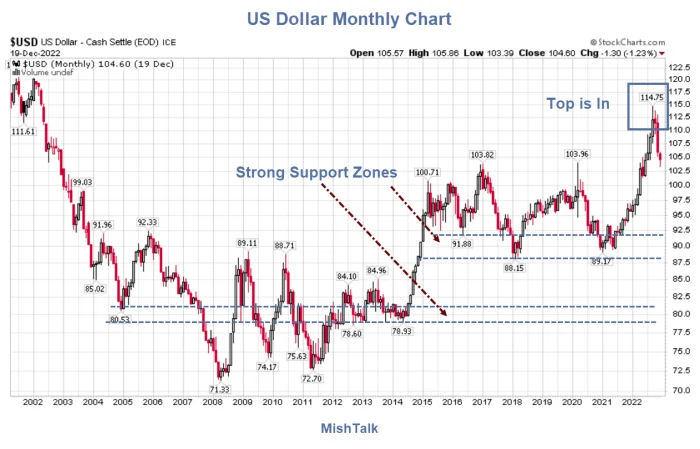

US dollar index monthly chart courtesy of StockCharts.com annotations by Mish

Yesterday, the Bank of Japan unexpectedly lifted its ceiling on 10-year government bonds from 0.25 percent to 0.50 percent.

Japan 10-year bond yield courtesy of Trading Economics

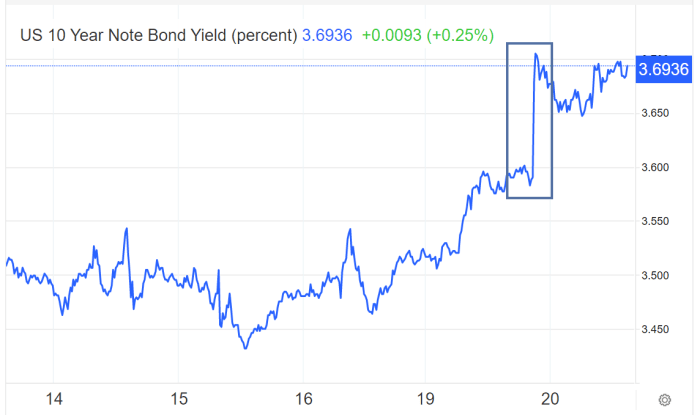

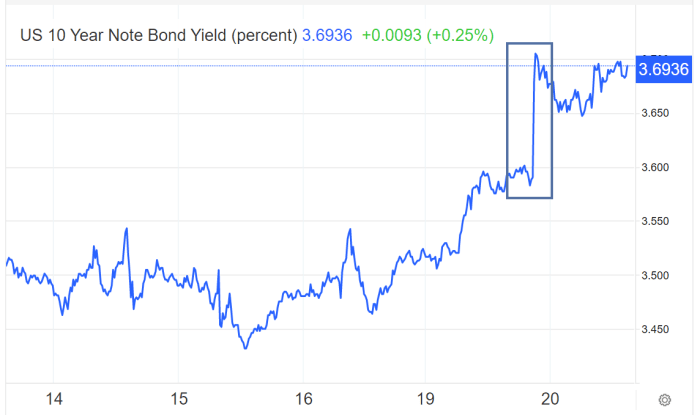

The BOJ lifted the ceiling to stop an unwelcome slide in the yen. In response, bond yields also jumped in the US.

US Treasury Note 10-Year Yield

US 10-year bond yield courtesy of Trading Economics

For the first time in a decade, all major central banks are tightening, with Japan still doing the least.

Long term, I doubt this rather pissy move by the Bank of Japan will do much of anything to US treasury yields.

And don’t expect the new cap to hold either. Speculators will again force the BOJ’s hand. Caps won’t work. They are a failed policy.

The same applies to ridiculous Buyers’ Cartel Oil Price Caps.

But what about the dollar?

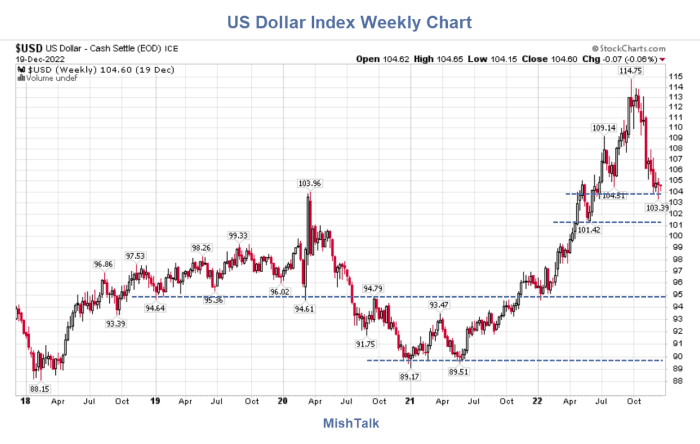

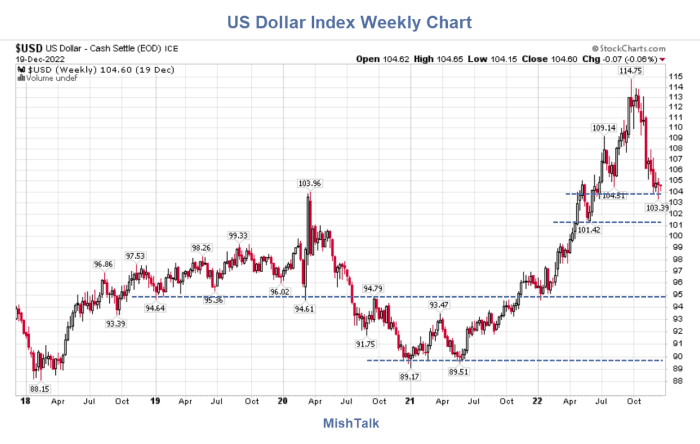

US Dollar Support Levels

On the monthly chart, there are strong support levels way below at 90 and 80.

A weekly chart shows additional support zones.

US dollar index weekly chart courtesy of StockCharts.com annotations by Mish

The US dollar is right at support. I do not expect much of a bounce here if indeed any.

There is minor support at 101 and much stronger support at 95. Given both monthly and weekly support at the 90 level, that is a good spot to bet on reasonable bounce in the dollar.

UDN US Dollar Index Bear Fund

US dollar index Bear Fund chart courtesy of StockCharts.com annotations by Mish

Dollar Fundamentals

- Deficit spending in the US is totally out of control.

- Rising treasury yields will consume increasing amounts of tax revenues

- The Fed is giving away billions of taxpayer dollars in free money to banks.

- US housing market is collapsing

- Corporate earnings are falling

- Consensus earnings are still too high

- The US stock market is still insanely overvalued, even on a relative basis to the rest of the world

- The US pace of tightening is slowing while tightening elsewhere rates to catch up a bit.

For discussion of free money, please see How Much Free Taxpayer Money is the Fed Giving to Banks?

In short, US dollar fundamentals stink.

This may not be the best entry as the dollar is right at support but UDN is worth considering here or on a bounce.

Understanding Long Term Moves in Gold, What’s Going On?

Also consider Understanding Long Term Moves in Gold, What’s Going On?