Outlook: To an overload of economic data we need to add worries about so-called stealth intervention from at least two sources, the Bank of Japan and the Swiss National Bank. Experts doubt the BoJ is intervening, despite a warning from FinMin Suzuki: “We cannot tolerate excessive currency moves driven by speculators. We are closely watching currency moves with a sense of urgency.” PM Kishida also said “speculative-driven rapid currency moves [are] problematic.”

But the dollar/yen moved to a 32-year high soon afterwards at 149.29 before retreating, and not sedately. Suzuki reminded the press the BoJ had intervened before (about $18 billion) and the government doesn’t always announce intervention. He also denies the primary cause is the BoJ cap on yields, saying lots of other factors are at work. The reports end up making Suzuki looking somewhat weak. Any loss of face is to be corrected and we expect the market to back down periodically ahead of any punishment.

As for the SNB conducting stealth intervention, nobody knows and if they do, they are not telling. We are willing to believe it if only one the highly unusual choppy pattern in the dollar/Swiss, even if euro/Swiss is or should be the focus. We have been studying charts for a very long time and choppiness like this in definitely not normal.

The most fundamental of the fundamentals is the cost of energy. It’s the central key determinative factor in a wide array of economic outcomes, and not just inflation. The FT has an article today citing the Qatari energy minister, who points out Europe may get through this winter okay but if the Ukraine war keeps going and Russia remains sanctioned, next year and beyond will be a different kettle of fish. Qatar warns that if Russia stops sending gas to Europe, it’s a vast problem because other sources are just not available. Russia supplied about 40% of Europe’s gas–and Qatar, the world’s largest producer, can divert only about 10-15% of its shipments from Asia to Europe. All Qatar’s plans to increase output don’t come online for several years. The FT emphasizes that Qatar has a long-term outlook driven by the need for investment planning and the long time it takes to build facilities and infrastructure. Asians understand this and have signed decades-long contracts, something the Europeans don’t want to do.

The FX forecast has to include periodic pullbacks in the dollar, which is what we are seeing now. They are not caused by any particular data point, although they can occur suspiciously around big changes in the S&P, as is happening this time for reasons no one can explain. Still, a pullback is not a reversal and we see nothing on the horizon to cause wavering from the strong dollar outlook.

Fun Tidbit: The FT reports a YouGov poll shows 10% of Britons approve of PM Truss.

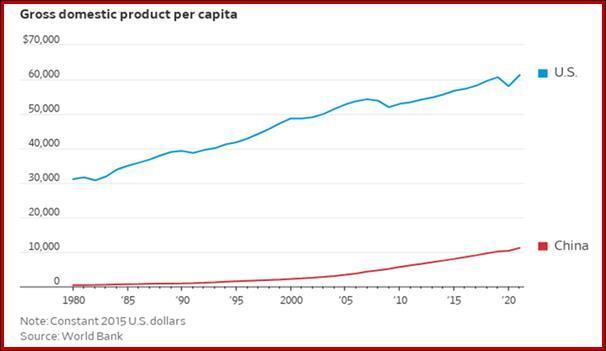

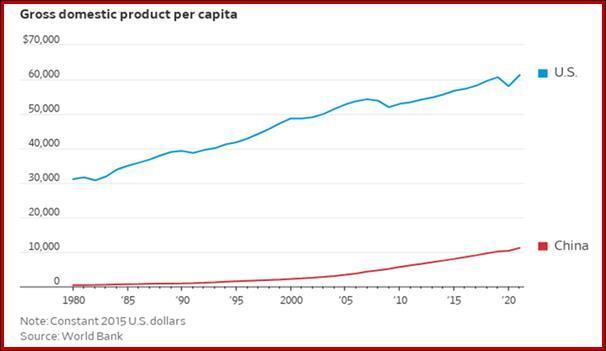

China Tidbit: Amid vast amounts of commentary on the Party congress in China and what it means, the WSJ delivered this chart. We think it’s a stunner. China beat the world in growth and in restructuring society to be a whole lot less poor, but it’s still an “emerging” market. A little less fear, please.

Tidbit: If you like economic/financial history, here’s a splendid moving chart of the UK pound through time with triggering events noted. It was posted on Twitter last weekend and as of Monday morning, had been viewed a million times. It was apparently designed by Bloomberg on BoE data but Interactive Investors is named, too.

US Political Tidbit: The US midterm elections are only three weeks away but early voting began yesterday in some states. Even top-notch pollsters like 538.com admit that the historical standard could get upended this time, meaning the party out of office that usually wins the midterms may not this time.

One important issue is the absurd lack of qualification (and character) of some candidates like the ageing football star in Georgia and the scammy TV doctor in Pennsylvania, not to mention the election-deniers and their followers who declined to watch the Jan 6 Committee hearings. Even so, the Dems may not prevail.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!