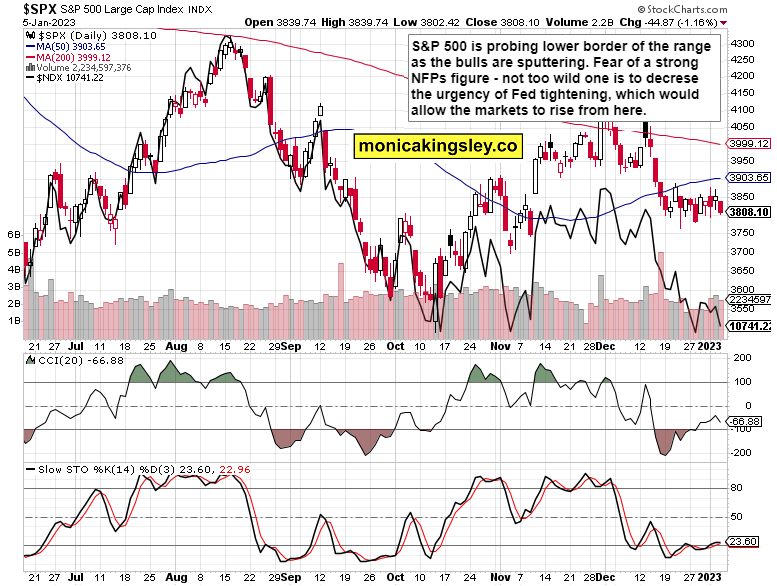

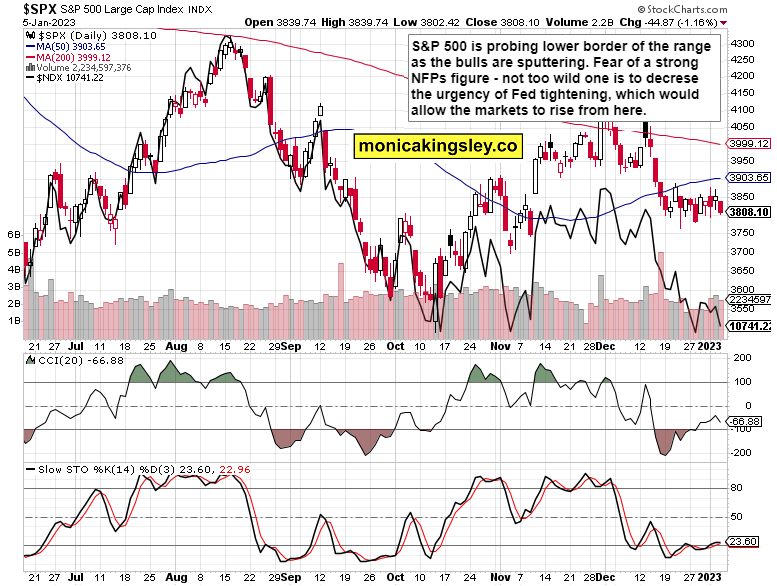

That‘s what S&P 500 needs – and with my patient call of the upside resolution to the recent range being more probable. For all the excitement of making another great call, don‘t lose the big picture view.

The not overly hot jobs figure allows for the Jan top to be made, with the first objective to be completed, being the upside break of 3,875. Note how well silver, copper, gold and oil are doing in the NFPs aftermath.

I‘ll keep commenting the live price action on Twitter as:

(…) The narrow window of opportunity to allow the market celebrate CPI while PPI continues raising its ugly head, is at hand.

Keep enjoying the lively Twitter feed serving you all already in, which comes on top of getting the key daily analytics right into your mailbox. Plenty gets addressed there (or on Telegram if you prefer), but the analyses (whether short or long format, depending on market action) over email are the bedrock. So, make sure you‘re signed up for the free newsletter and that you have my Twitter profile open with notifications on so as not to miss a thing, and to benefit from extra intraday calls.

Let‘s move right into the charts.

S&P 500 and Nasdaq outlook

3,875 is likely to give today, and 3,895 – 3,910 zone awaits for Monday. Yes, be patient because stocks are running with a Fed tightening misperception – the central bank isn‘t backing off.

Gold, Silver and miners

Silver will again rise from here, it‘s a matter of very short time till $23.80 goes in the rear view mirror. Note also my yesterday‘s tweets about fine reversals in GDX and SIL.

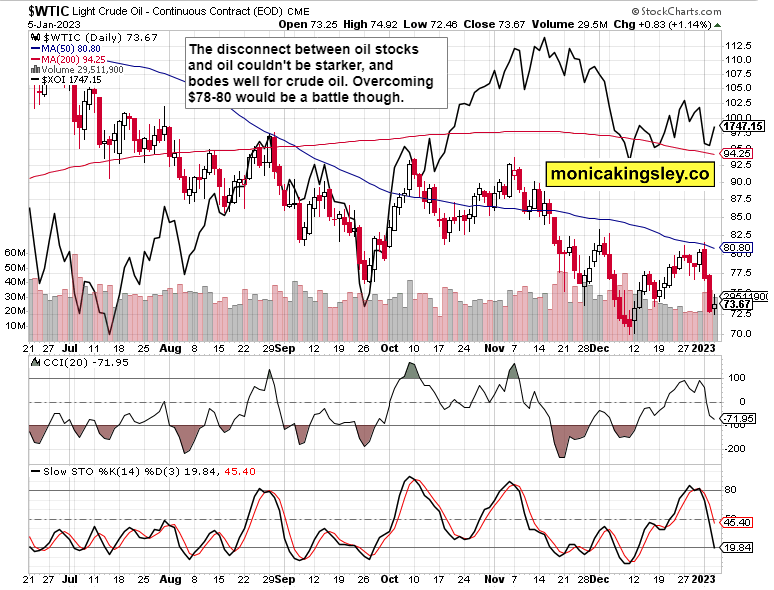

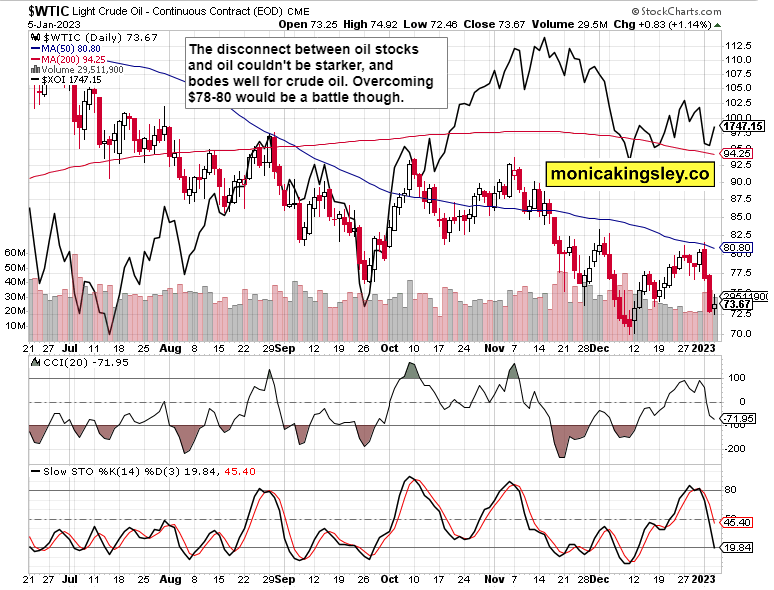

Crude Oil

Crude oil, this laggard of 2023, is hesitantly starting to move as well, but don‘t expect miracles too soon or too fast. Still worth holding here for more upside though. As 2022 was the year of energy, and 2023 would belong to metals and agrifoods.