Equity markets have got off to a flier this year despite concerns over a slowing global economy, and central banks that look set to hike rates even further in the coming weeks.

The IMF has come across as equally as gloomy about the outlook saying that they expect that a third of the global economy will fall into recession in 2023.

Despite these concerns and a steady increase in interest rates since the October lows, equity markets saw a strong end to 2022 and this has continued into 2023, however it is notable that markets in Europe are outperforming those in the US.

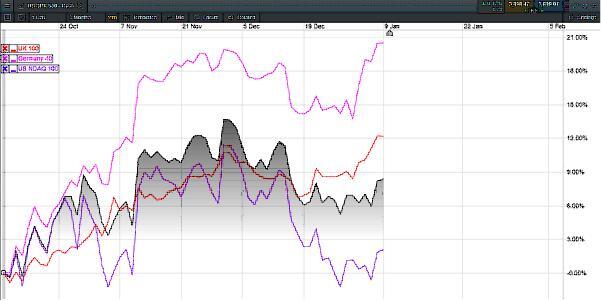

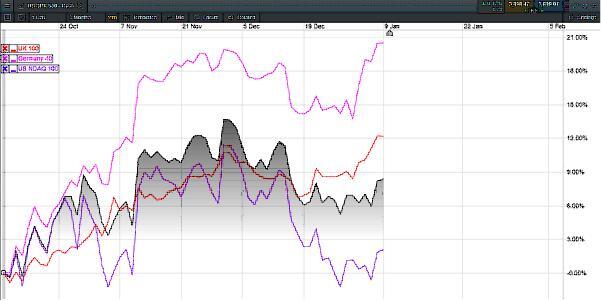

This disconnect is no better illustrated than in the chart below which has seen the Nasdaq 100 and S&P500 struggle to keep track of the FTSE100 and DAX.

Equity market performance since October lows

Source: CMC Markets

The DAX has led the way, rebounding by 20% from its October trough, while the FTSE100 has also performed well, as US markets have struggled, even though yields across all the major markets have moved higher as future rate rises on both sides of the pond continue to get priced in.

This continued expectation of higher rates appears to be being tempered by the prospect that central banks are closer to the end of their hiking cycle than the beginning.

While that may be true, and inflation is coming down, prices still remain high and inflation sticky, and as such it’s hard to envisage a situation where the Federal Reserve would want to signal that it is starting to go soft as rates move closer to their terminal level, wherever that level may be.

This would suggest that market pricing of a 25bps rate hike in February may well be optimistic and that further upside surprises in yields, as well as the US dollar, are likely to be forthcoming in the coming weeks.

Against such a backdrop, and the fact that US markets have underperformed since October, there is a feeling that investors see more value in European markets than they do in US markets at the moment.

This seems entirely sensible when you look at how much US markets have outperformed European markets over the last decade, with the Nasdaq 100 up over 300% compared to the DAX which has doubled in value.

With interest rates anchored close to zero for most of the last 15 years, and tech largely driving the rebound in valuations we appear to be getting to the point where these valuations are now starting to come under greater scrutiny now that interest rates are normalising.

We have now moved from a TINA (There Is No Alternative) world, to a world where money now has a value, and we can see now that a lot of tech stocks are being held to a higher benchmark when it comes to their growth potential.

Looking at the T12 dividend yield for the Nasdaq 100, which shows a value of 0.98% is an interesting comparison when you consider the US 2-year yield is at 4.25%.

Compare that to the DAX and FTSE100 which have forward dividend yields of 3.4% and 4.23% and then look at the equivalent German yield at 2.6%, and UK 2-year yield at 3.4%, and the comparison is even starker, begging the question as to why we shouldn’t see further divergence between US and European markets in the weeks ahead.

Looking at US markets through this lens its entirely plausible you could see a situation where the FTSE100 and DAX continue to make new highs, while the S&P500 and Nasdaq 100 continue to look weak dropping below their October lows in the process now that there is an alternative in this higher interest rate and inflation environment.