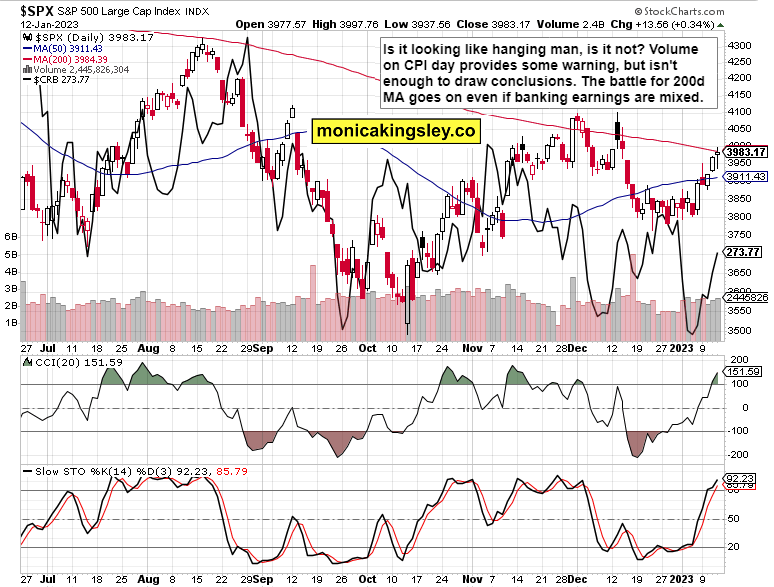

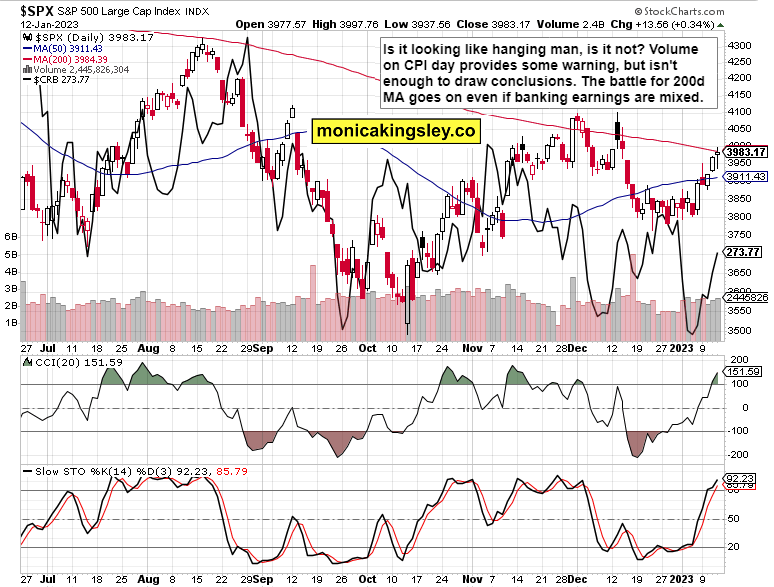

S&P 500 didn‘t like CPI coming in line with expectations, and it was indeed„ buy the rumor sell the news“ reaction, followed by cutting into 4,010 on confirming bond and dollar price action. No fresh fuel though making for a larger reaction.

And today we have some telling bank earnings, facilitating the approach to 3,955 – and University of Michigan consumer confidence data which wouldn‘t prove any huge disappointment. Just around the expected figure, making for an uneventful session Friday, with the only two daily questions being whether the buyers can reconquer 3,980, and whether the sellers can push below 3,955 closer to 3,910 or at least midpoint.

Remember, the Fed is hawkish and will remain hawkish, and the rally is running on borrowed time.

Keep enjoying the lively Twitter feed serving you all already in, which comes on top of getting the key daily analytics right into your mailbox. Plenty gets addressed there (or on Telegram if you prefer), but the analyses (whether short or long format, depending on market action) over email are the bedrock. So, make sure you‘re signed up for the free newsletter and that you have my Twitter profile open with notifications on so as not to miss a thing, and to benefit from extra intraday calls.

Let‘s move right into the charts.

S&P 500 and Nasdaq outlook

Given the banking earnings aftermath, the key „point of control“ at 3,955 has to hold so as to prevent levels mentioned in the opening part of today‘s analysis. Close above 3,980 would be ideal for the bulls, but unless 4,010 is cleared, stocks remain in a precarious zone, and vulnerable to swift reversals at the 200-d MA.

Copper

Copper consolidation mentioned yesterday, looks to be starting. Risk-on consequences, so watch out.