COT data is very important for gold as it’s tracked closely by a lot investors and speculators, especially for a longer-term approach. Looking at the Non-Commercials or Large Speculators, we can see that those are still heavily short, but they are approaching similar readings compared to 2013, 2015 and 2018. Notice that all of those extreme levels lead to a reversal, a rise in price, which can be very interesting now as well, especially when adding an Elliott wave count that shows a five wave drop from the high, now in late stages. In fact, there can be an ending diagonal with nice support at 1600/1610.

GOLD COT Data

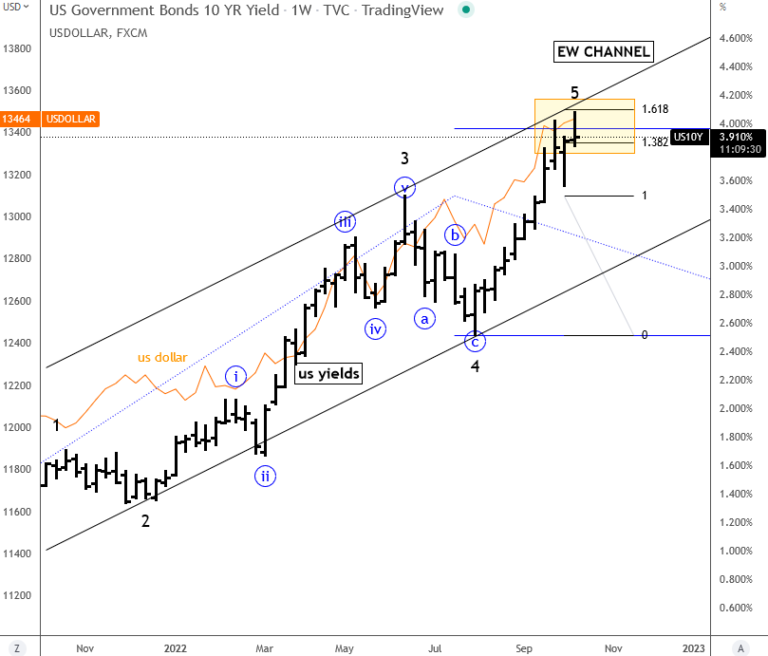

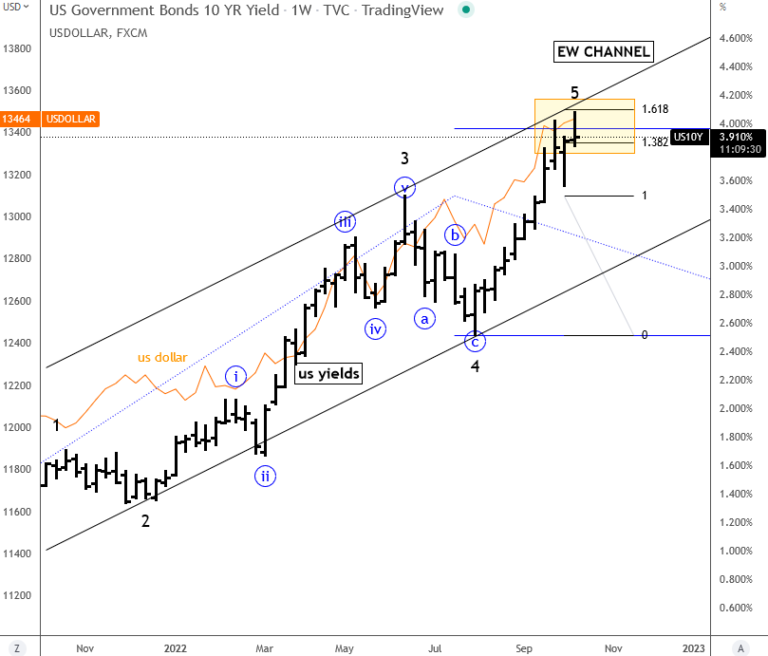

At the same time, we have to respect the US yields of course, which are still on the rise and that’s why we see gold coming down as USD trades higher in risk-off environment. So for gold to recover we also have to ask ourselves, what can trigger a turning point? Well, it can be the FED, if they will be forced to slow down the hawkish approach next year, possibly if jobs data gets worse, or if they will be successful fighting the inflation. From an Elliott wave perspective, we see 10 year US yields in late stages of an impulse, so a slow down of a bull run would not be a surprise, since we know that after every five waves market makes a minimum three wave retracement.

US10Y Weekly Chart

GOLD Daily Chart

So, will gold really slow down and turn higher next year? It’s too soon to tell, but so far we have some nice development here, which will be interesting to track from an intraday perspective as well. So if you like gold, silver or dollar, make sure to check our services where we offer Elliott wave updates on a daily basis.

Get Full Access To Our Premium Analysis For 14 Days. Click here!