US payrolls rose by 239,000 in October, according to Wednesday’s report out of the Automatic Data Processing firm (ADP), beating economists’ estimates for a 178,000 increase.

The main highlight of the day, however, was the Fed delivering its fourth consecutive 75-basis point rate hike. This hauled the Federal Funds Rate to a target range of 3.75% to 4.00%. Interestingly, December’s Fed Funds Futures market is now pricing in a 59% probability of only a 50bp hike at 14th December meeting. The aftermath of the release witnessed the US Dollar Index plunge 0.6%, taking the DXY back to within striking distance of 110.00. Dollar weakness was short-lived, nevertheless, pulling off session lows to within pre-announcement levels as markets staged a U-turn amid Fed Chair Powell’s Hawkish comments during his presser:

‘Rates need to move beyond the September Dot Plot forecasted (median 4.6%)’.

‘It is very premature to be thinking about pausing rates’.

Essentially, his message was repricing the terminal rate higher and price out any rate cuts for next year.

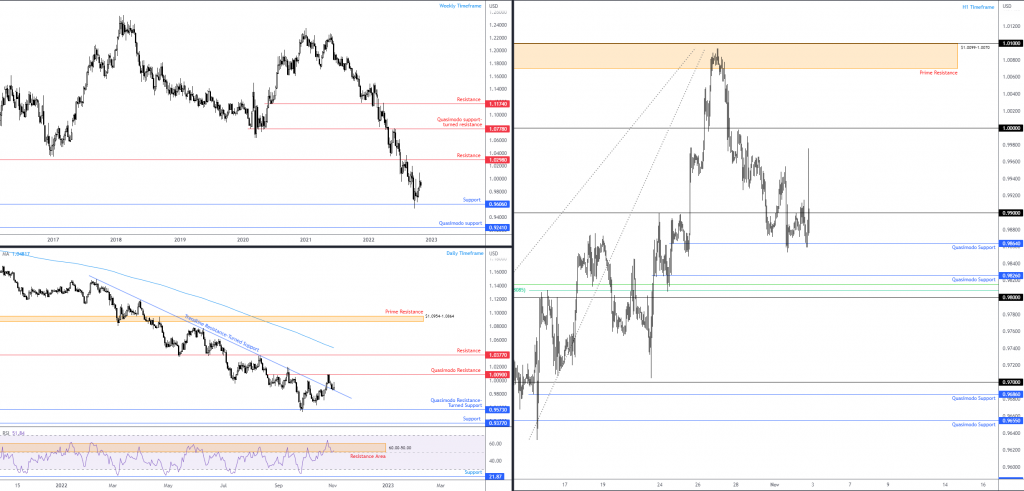

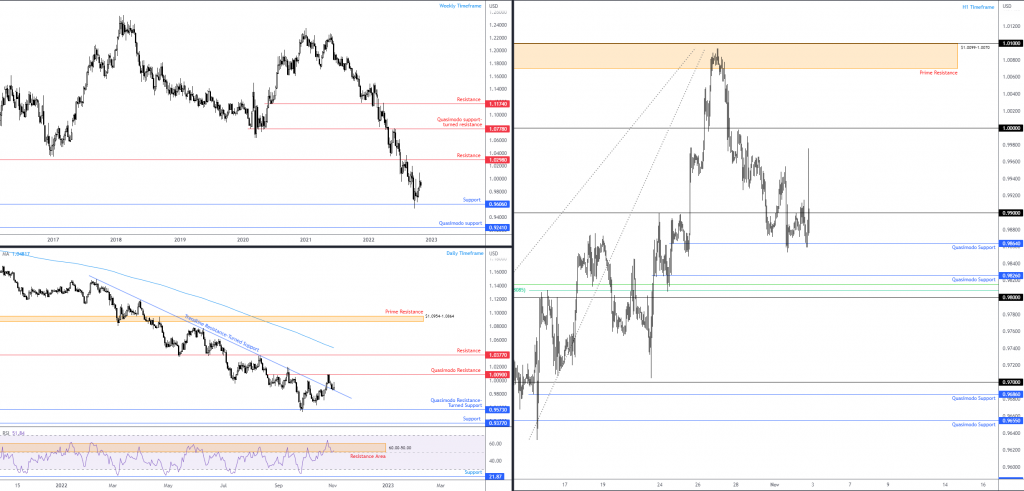

Major US equity indices initially rallied on the back of the release, though upside proved short-lived for the S&P 500, topping at a high of 3,894 and stepping beneath pre-announcement levels. A similar whipsaw was seen in EUR/USD, punching to a session peak of $0.9976 before retreating south of the $0.99 figure, leaving behind a ghastly upper candle shadow on the hourly chart.

EUR/USD:

Daily trendline resistance-turned support on the daily timeframe, extended from the high of $1.1495, remains in the spotlight, evidently under pressure and on the verge of ceding ground. This follows last week’s rejection of daily Quasimodo resistance from $1.0090. Clearing the noted trendline support uncovers a familiar daily Quasimodo resistance-turned support coming in at $0.9753.

A break lower is supported by the overall trend: lower since topping in January 2021. Adding to the bearish narrative is the daily chart’s relative strength index (RSI) retesting resistance between 60.00 and 50.00.

This places a bold question mark on H1 Quasimodo support from $0.9864, with the unit threatening to push lower today and possibly encourage short-term breakout selling towards H1 Quasimodo support at $0.9826 and possibly the $0.98 region.

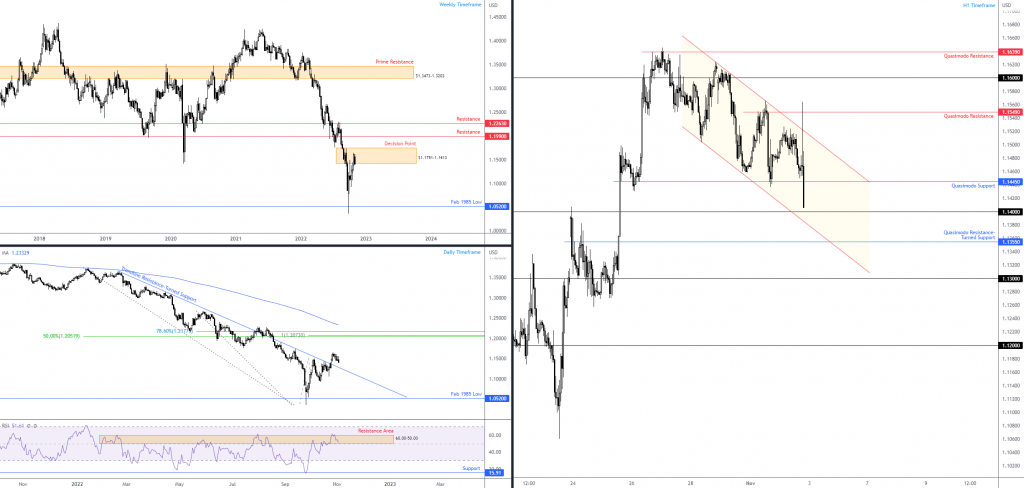

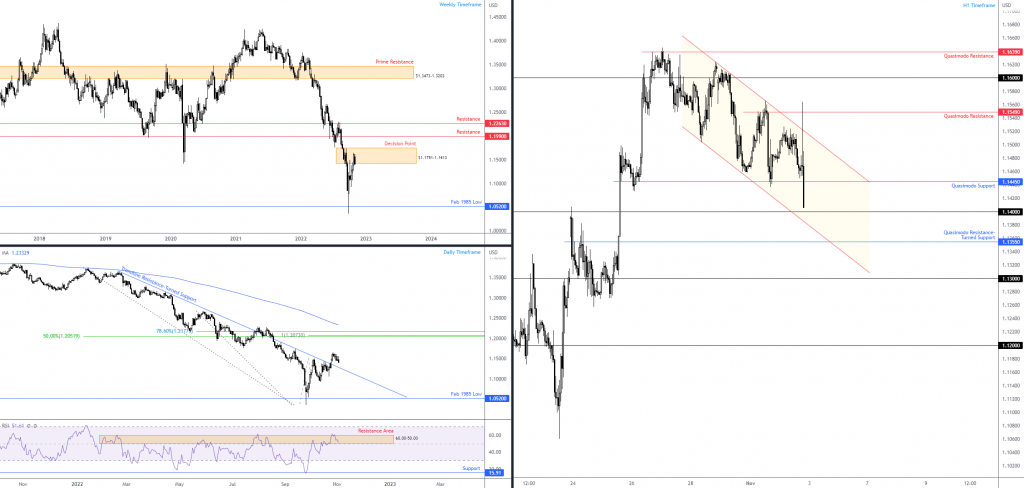

GBP/USD:

It was a similar story for GBP/USD on Wednesday; the currency pair initially staged an advance in the aftermath of the release, spiking to a high of $1.1564 and touching gloves with H1 Quasimodo resistance coming in at $1.1549. As evident from the H1 chart, price dipped under Quasimodo support from $1.1445 in recent trading and is now within a stone’s throw of reaching $1.14 and a neighbouring channel support, taken from the low $1.1503. Breaching the aforementioned levels casts light towards H1 Quasimodo resistance-turned support at $1.1355 and then potentially to $1.13.

Technically speaking, recent downside should not be a surprise. The weekly timeframe has price action testing the inside of a decision point at $1.1751-1.1413, alongside the daily chart’s relative strength index (RSI) resistance between 60.00 and 50.00 welcoming the indicator. This is also supported by the dominant downtrend visible on the weekly timeframe since topping at $1.4250 in June 2021.

Therefore, going on the above, a break under $1.14 on the H1 scale should not surprise, action perhaps igniting short-term breakout selling in the direction of H1 Quasimodo resistance-turned support at $1.1355 and potentially to $1.13.