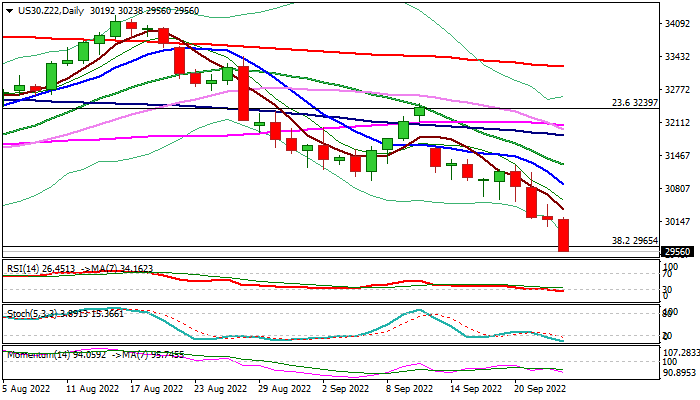

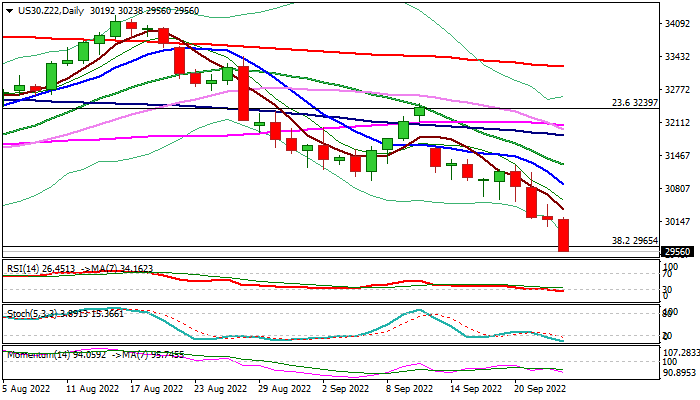

The Dow Jones was sharply down on Friday, losing around 1.5% for the day until the mid-US session and extending sharp fall into fifth straight day.

The index is also on track for a big weekly loss of over 4% and also for a second consecutive week in red.

Strong risk aversion on growing fears of a recession as well as concerns about the strength of the impact of aggressive Fed’s policy tightening on corporate earnings, was the main driver of the price.

Fresh weakness pressures key supports at 29654/29638 (Fibo 38.2% of 18044/36830, 2020/2022 rally / 2022 low of June 17), break of which would generate strong bearish signal for further acceleration lower and expose targets at 28875 / 27437 (55MMA / 50% retracement of 18044/36830).

Bearish studies complement to weak sentiment and only substantial change in fundamentals could slow or reverse the current steep fall.

Meanwhile, limited corrective upticks on oversold conditions and profit-taking would provide better levels to re-join strong downtrend.

Res: 30000; 30107; 30238; 30395

Sup: 29000; 28875; 28000; 27437