The dollar eased after US labor data on Friday, as US economy added 223K jobs in December, beating expectations for 200K increase, but wage growth slowed slightly (Dec 0.3% m/m vs 0.4% Nov / f/c) and unemployment fell to 3.5% from 3.6%, hitting pre-pandemic levels.

The data suggest that the labor market remains tight, but also fuel expectations for softer approach by the central bank in its policy meeting in February, as bets for 25 basis points rate hike rose from 54% to 67%, while expectations for 0.5% raise dropped to 33%.

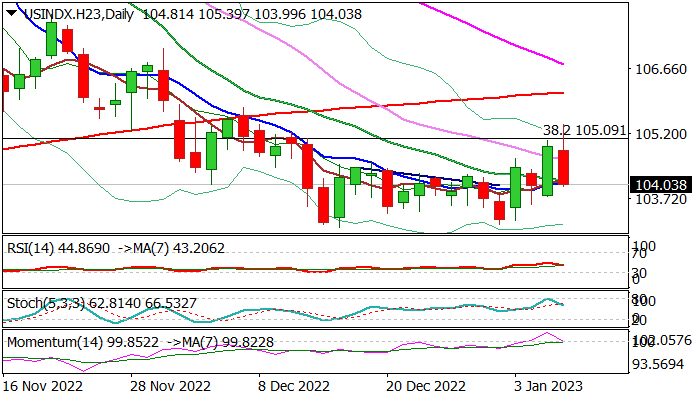

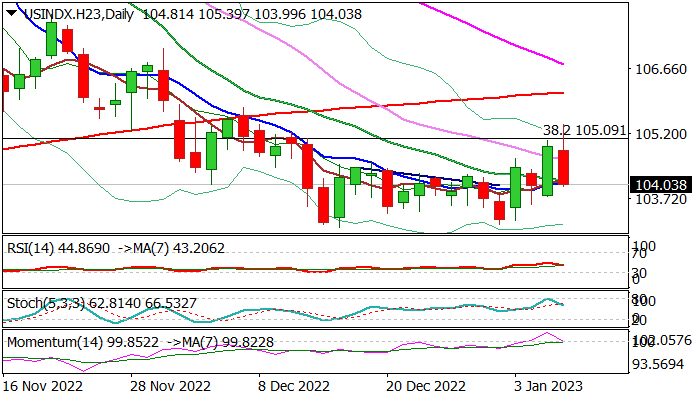

Slightly calmer view of Fed’s hawkishness deflated the dollar index, which reversed the largest part of its Thursday’s rally, after bulls were trapped above daily Kijun-sen (105.10) that would add to negative impact from fundamentals.

Daily studies show momentum indicator heading south and breaking into negative territory, which contributes to bearish signals.

Fresh weakness looks for Friday’s close below daily Tenkan-sen (104.26) to further weaken near-term structure and keep recent multi-month lows at 103.12/06 (Dec 30/15) under increased pressure, with break lower to signal continuation of larger downtrend from 2022 high (114.72).

Only firm break above daily Kijun-sen would bring bulls in play for fresh recovery.

Res: 104.81; 105.10; 105.70; 106.24

Sup: 103.77; 103.38; 103.06; 102.11