- Gold remains near record highs and achieved its highest monthly close ever in November.

- Global bond yields continue to decline as inflation further cools, supporting the upside in XAU/USD.

- With central banks expected to remain on hold, the focus will be US labor market data.

Gold decisively broke above the $2,010 level and moved closer to the record high area, boosted by a decline in global government bond yields. Evidence that inflation continues to edge lower in Europe and the US solidifies expectations that the Federal Reserve (Fed), the European Central Bank (ECB), and other central banks are finished with interest rate hikes. This has also bolstered equity prices and kept the US Dollar under pressure. Next week’s data, particularly US jobs figures, could challenge the current market sentiment, sparking a new debate.

Gold shines, inflation slows

Gold not only broke above $2,000 but also surpassed the significant $2,010 level, positioning itself to challenge record highs. In November, XAU/USD achieved its highest monthly close ever.

A key factor driving the increase in Gold prices was the decline in government bond yields worldwide. Data showed a slowdown in inflation in November in the US, Europe, and Australia at a faster-than-expected rate, to the envy of many Argentinians.

In Germany, the annual rate of the Consumer Price Index (CPI) stood at 3.2%, while in the Eurozone, it was at 2.4% (with core inflation at 3.6%). These figures are closer to the European Central Bank’s (ECB) target and suggest that no further tightening would be necessary in the near future. With a gloomy economic outlook ahead, the debate is shifting towards when the ECB will cut rates. This expectation has pushed European yields lower.

While the European economy stagnates, the US continues to grow above trend. Market participants learned during the week that the US economy expanded at an annualized rate of 5.2% in the third quarter, higher than the previously reported 4.9%. This confirms that the US is still far from a soft landing. It does not imply that the Fed will raise rates further, but it leaves the door open for the central bank to do so if inflation rebounds.

However, some warning signs are emerging. The Beige Book signaled that “business activity continued to decline slightly” from early October to November 17. Continuing jobless claims resumed an upward trend, surging by 86,000 in the week ending November 18, reaching the highest level since November 2021.

Comments from Federal Reserve officials during the week varied. However, the overall tone remains that, for the time being, the Fed will maintain its policy unchanged, adhering to the “higher for longer” mantra. Doves mention that a sufficiently restrictive policy is in place, while hawks warn that they would support further rate hikes if “inflation progress stalls.”

Lower yields, a depreciation of the US Dollar, and higher equity prices point to loosening financial conditions, which do not support the Fed’s intentions. This adds more pressure on officials to avoid a dovish tone.

Focus on US jobs data

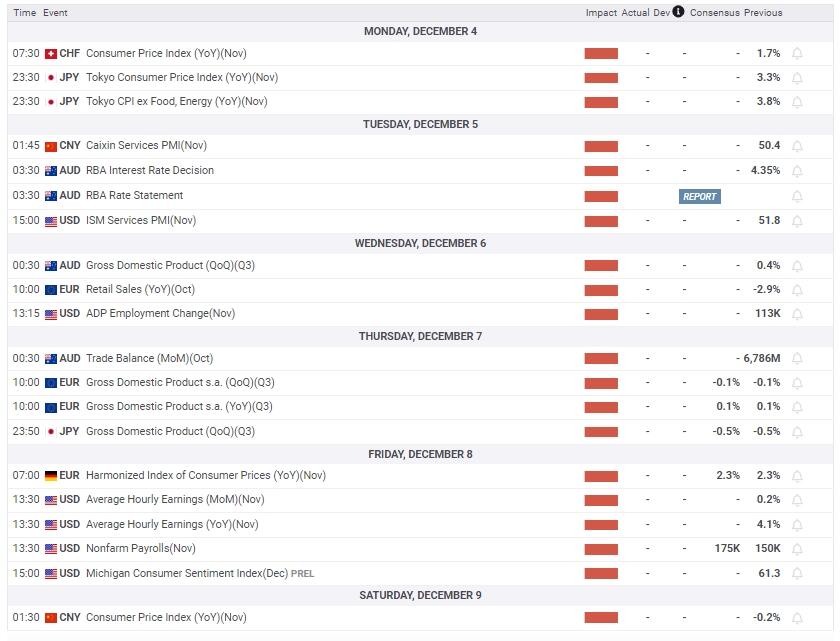

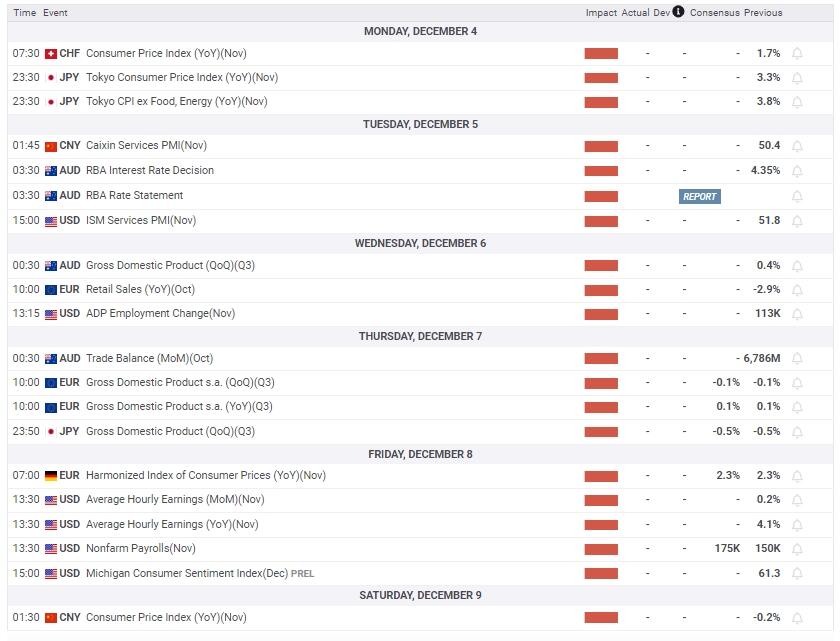

Next week, the Reserve Bank of Australia (RBA) will announce its decision on monetary policy with no expected change. The same applies to the Bank of Canada (BoC). Market participants won’t be hearing from Federal Reserve officials as the central bank enters the blackout period ahead of the December 12-13 FOMC meeting.

The crucial economic figures will come from the US labor market. On Tuesday, the JOLTS Job Openings report will be released, followed by the ADP Private Employment Change on Wednesday, and weekly Jobless Claims on Thursday. And finally, the Nonfarm Payrolls report on Friday. These figures could have an impact on Gold.

Evidence of a more balanced job market will reinforce the notion that the Fed is done raising rates and could further boost the price of Gold towards record highs. Even numbers aligned with expectations could trigger more gains in XAU/USD. However, upbeat figures that show a still-tight labor market could strengthen the US Dollar and weigh on Gold.

The uptrend for XAU/USD is likely to remain in place as the market focuses on the Fed not raising rates further. If the focus changes to the US economy outperforming, then the US Dollar could start gaining momentum and potentially limit the upside in metals. Given the current level of Gold price, this could lead to an intense correction.

Gold technical outlook

The weekly chart shows that the upward trend in Gold is strong and points towards a test of record highs around the $2,085 area. A weekly close below $2,010 would suggest that XAU/USD is not yet ready for new historical levels. Technical indicators on the weekly chart are bullish. However, considering Gold’s level, the upside is not risk-free and could be susceptible to sharp corrections.

A decline below $2,010 could extend to $1,975, with the next strong support at $1,930. On the upside, a consolidation above $2,050 would clear the way for a test of $2,080. A further breakout higher would shift the focus to $2,100.