- Gold registered losses for the second consecutive week.

- The technical outlook suggests that the bearish bias remains intact.

- Sellers could take retain control in case $2,000 is confirmed as resistance.

Gold declined for the second consecutive week, pressured by the recovering US Treasury bond yields and renewed US Dollar (USD) strength. Next week’s economic calendar will feature February PMI data and FOMC Minutes. Whether or not $2,000 holds as resistance will also be key for XAU/USD’s next directional action.

Gold price turned south following hot US inflation data

Gold edged lower at the beginning of the week and registered small losses on Monday. As investors refrained from taking large positions ahead of the key inflation data from the US, however, XAU/USD’s action remained limited.

The US Bureau of Labor Statistics reported on Tuesday that the Consumer Price Index rose 3.1% on a yearly basis in January. This reading came in above the market expectation of 2.9%. Additionally, the Core CPI, which excludes volatile food and energy prices, increased 3.9% to match December’s print. As the CME FedWatch Tool probability of the Federal Reserve (Fed) leaving the policy rate unchanged in the next two policy meetings climbed above 60% after the CPI data, the benchmark 10-year US Treasury bond yield advanced to 4.3% and Gold declined below $2,000 for the first time in 2024.

After gaining 0.7% on Tuesday, the US Dollar (USD) Index corrected lower and closed in negative territory on Wednesday. In turn, XAU/USD fluctuated in a tight channel at around $1,990 following the previous day’s sharp decline.

The data from the US showed on Thursday that Retail Sales fell 0.8% to $700.3 billion in January. Retail Sales ex Autos contracted by 0.6% in the same period. The 10-year US yield declined toward 4.2% after the disappointing data and allowed XAU/USD to recover back above $2,000 in the second half of the day.

Commenting on inflation data, Fed Vice Chair for Supervision Michael Barr said policymakers are confident that inflation is on the path towards the 2% target. Barr, however, added that he would need to see “continued good data” before advocating for a rate cut.

Gold failed to build on Thursday’s recovery gains on Friday after producer inflation data from the US. The BLS announced that the Producer Price Index (PPI) for final demand rose 0.9% on a yearly basis in January. This reading followed the 1% increase recorded in December but came in above the market expectation of 0.6%. The annual Core PPI rose 2% in the same period, compared to December’s increase of 1.8%. On a monthly basis, the Core PPI was up 0.5% following the 0.1% decline recorded in the previous month. The 10-year US yield climbed back above 4.3% with the initial reaction and made it difficult for XAU/USD to stretch higher ahead of the weekend.

Gold price could react to PMI data next week

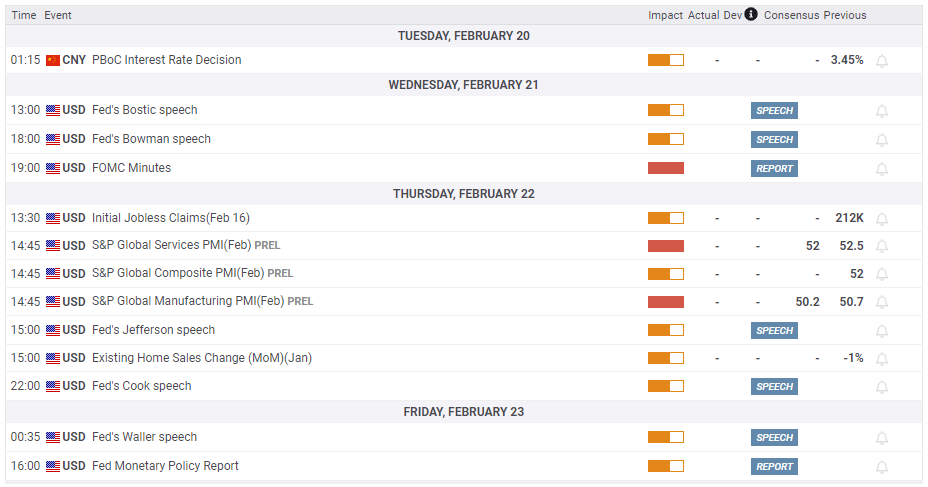

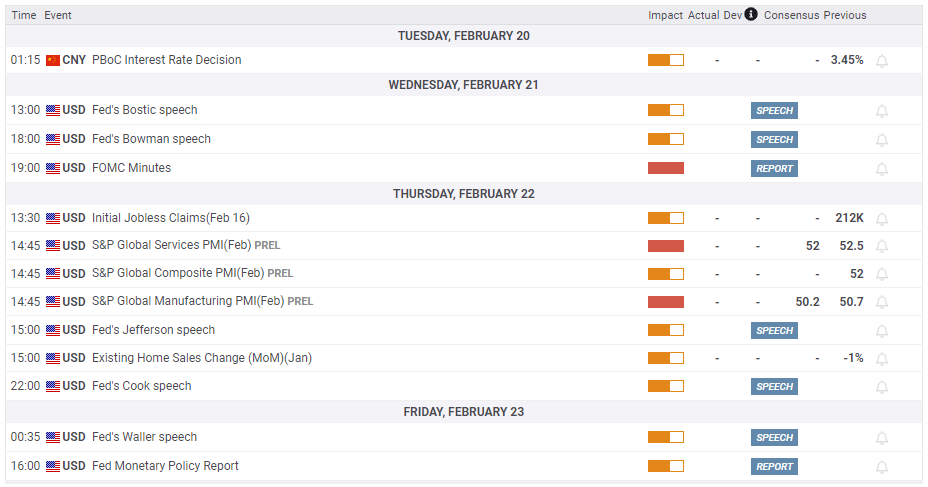

Stock and bond markets in the US will be closed on Monday in observance of the President’s Day holiday.

On Wednesday, the Fed will release the minutes of the January 30-31 policy meeting. In the post-meeting press conference, Fed Chairman Jerome Powell said that a rate cut in March was not likely but noted that an unexpected weakening in the labor market could make them consider a rate reduction sooner. The impressive January jobs report after the meeting caused investors to refrain from pricing in a March rate cut and didn’t allow Gold to gain traction in the first half of February.

At this point, investors are more interested in whether the Fed will wait until June to execute a policy pivot. Hence, the Fed’s publication is unlikely to offer fresh clues regarding the timing of the rate cut.

On Thursday, S&P Global will release the preliminary Manufacturing and Services PMI reports for February. An unexpected weakening in the private sector’s business activity, with either of the headline PMIs dropping below 50, could revive expectations for a May rate cut and help XAU/USD gain traction with the immediate reaction. Investors will also pay close attention to comments regarding price pressures in the surveys. In case the input inflation in the service sector proves to be sticky, the USD could stay resilient against its rivals and limit the metal’s upside even if the PMI readings disappoint.

Gold technical outlook

The Relative Strength Index (RSI) indicator on the daily chart stays below 50, suggesting that the bearish bias remains intact. However, sellers could refrain from betting on further Gold weakness after XAU/USD closed above the $2,000 psychological level on Friday, which is reinforced by the 100-day Simple Moving Average.

In case $2,000 stays intact as support, $2,020 (Fibonacci 23.6% retracement of the October-December uptrend, 20-day SMA) could be seen as next resistance before $2,030 (50-day SMA).

If Gold returns below $2,000 (100-day SMA, psychological level) and starts using that level as resistance, $1,980 (Fibonacci 38.2% retracement) and $1,965 (200-day SMA) could be set as next bearish targets.