Stocks are lower across the board on Tuesday and the key driver is the revaluation of rate cut expectations. The market has scaled back the prospects for a US rate cut in March. The CME Fedwatch tool is now pricing in a 69% chance of a cut, this had been above 75% on Monday. The increase in Treasury yields comes on the back of some hawkish commentary from the ECB, and further attacks on commercial vessels in the Red Sea.

More Red Sea disruption, but will it really impact inflation?

The WSJ is reporting that Shell has suspended Red Sea transits indefinitely, and overnight Qatar said that shipments of LNG would be delayed due to the unrest. The reaction in the oil markets has been fairly muted so far, the Brent crude price is up by less than 1%, and remains below $80 per barrel, and UK natural gas prices have risen only slightly after falling last week. However, the attacks are a warning sign that supply disruptions could come back to haunt the market.

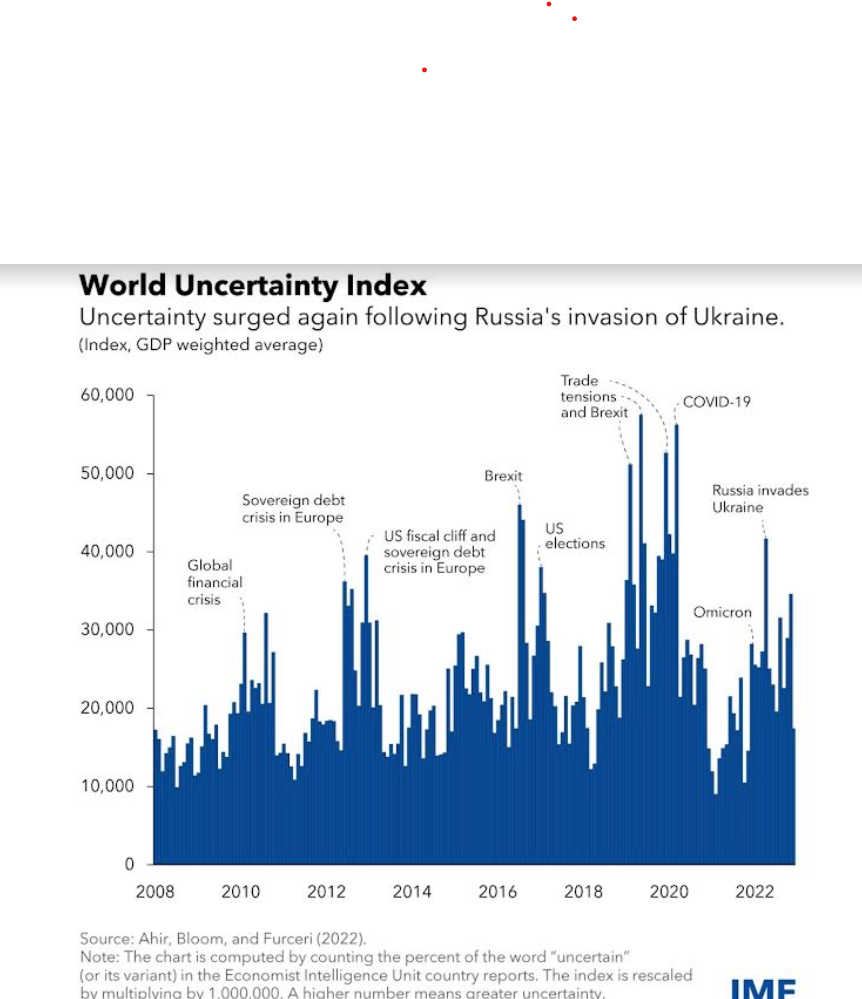

We mentioned last week that the Vix, the index that measures volatility in the S&P 500, was at subdued levels. The Vix has picked up in the last 24 hours and is now back above 13. This is still low by historic standards. While the Vix seems to be underestimating risks that could derail stock markets in the future, the IMF produces a chart called the World Uncertainty Index. As you can see, this has risen in the last quarter of 2023, as geopolitical tensions come back into focus.

Chart: IMF world uncertainty index

Source: IMF

Traders need to be aware of the magnitude of the increase, because the greater the uncertainty the more this can impact stock prices. Right now, the increase in global uncertainty is manageable. Although ships are being attacked on the Red Sea, many are still sailing through. Added to this, it takes an extra 9 days approx. to reroute ships and avoid the Suez Canal and sail around the horn of Africa. This is annoying, but it should not cause the magnitude of supply disruptions that we saw during the pandemic era. Overall, the markets are right to reassess the level of the Vix, and to scale back some of the interest rate cuts it had been expecting in recent weeks. However, there is no panic in the market.

Watch Waller comments for market direction

Added to this, the 10-year Treasury yield may have popped above 4% on Tuesday, but Fed member Christopher Waller, a member of the board of governors of the Federal Reserve System, is speaking later today. His comments are worth watching since he is a noted dove. Comments that he made at the end of November were considered to be dovish and supportive of rate cuts. This was seen as a precursor to the Fed’s pivot at its December meeting. Thus, Waller’s comments will be watched closely in case they give us a steer on what to expect from the Fed in the coming weeks, and whether a March rate cut is likely. The disinflation trend is mostly intact, even with the uptick in prices in December, and there have some weak labour market indicators recently, which could see Waller maintain his dovish message.

Thus, although stocks are falling alongside bonds (bond yields are rising), and the dollar is higher, these trends could reverse course if Waller signals a rate cut is coming in March.

A bad earnings season could clear the decks for a recovery for financials in 2024

Both Goldman Sachs and Morgan Stanley reported weak earnings for 2023. Goldman reported its lowest annual profits in 4 years, although its performance picked up in the final quarter. Investment banking remains a bleak spot as deal making levels are subdued. Morgan Stanley saw its profits fall by a third in Q4, as its wealth management division saw costs rise. For 2023 as a whole, Morgan Stanley saw profits fall by 17% to $9.1bn. Overall, US bank earnings for Q4 have been disappointing, with few of the large US banks benefiting from strong net interest income, although JP Morgan reported a record quarter in Q4. The financial sector in the S&P 500 has lagged the overall index this year and has been basically flat since the start of January. The financial sector also underperformed the S&P 500 for 2023 as a whole, rising a mere 5%. At the time of writing, Goldman Sachs and Morgan Stabley’s share prices were higher, as the markets shrugged off the weak earnings data, however, both stocks have a long way to go to catch up with the overall market.

CPI could see the UK fall back in line with its peers

Elsewhere, the UK’s CPI data will be worth watching closely on Wednesday. The market is expecting the annual rate of headline CPI to fall to 3.8% from 3.9%, and for inflation to fall to 4.9%. The UK is expected to buck the trend of higher global inflation for December, and if expectations are correct and headline inflation does fall a notch then it would be the first time in 2 years that the UK’s inflation rate is below that of France. Core price growth is also expected to grow by less than 5%, for the first time in 2 years. Areas where inflation fell in December include mortgage rates, petrol prices and food prices. However, energy prices have picked up since January, so we can’t rule out a further uptick in price pressures.

GBP/USD fell sharply on Tuesday on the back of receding wage growth; however, it has picked up from the lows around $1.2620, and is currently trading above $1.2660. GBP/USD has rallied since September, however, as the dollar gains strength it is coming under pressure, and it has fallen consistently since the start of the week. In the short term, momentum in GBP is to the downside, however, a surprise uptick in the December inflation figures could lead to a recovery in GBP/USD.

Chart: GBP/USD daily chart

Source XTB: Past performance data is not a reliable indicator of future performance